Page 42 - ar2022_en

P. 42

Building Age, Ownership and Condition

About two thirds of the IBs (i.e. 880 IBs) were built before

1987 and about 60% were situated in “I” and “OU(B)” Majority of the pre-1987

zones in metro areas. More than 28% of the pre-1987 IBs under single

1

IBs (i.e. 254 IBs) were under single ownership , mainly ownership are located in

in Eastern Kowloon and Tsuen Wan. Despite the aging Eastern Kowloon and

stock, most of the IBs were in fair (about 89%) or good Tsuen Wan

(about 7%) condition.

Vacancy

2

The overall vacancy rates of private flatted factories and private storage buildings in 2020

were 6.4% and 5.4% respectively. Vacancy rates have been maintained at relatively low

level (below or equal to 6.8%) since 2015.

KEY FINDINGS AND OBSERVATIONS

An on-site survey to collect information of IBs was conducted from December 2019 to

December 2020. The findings are approximated from the surveyed units (some 45 753

units) under stratified sampling.

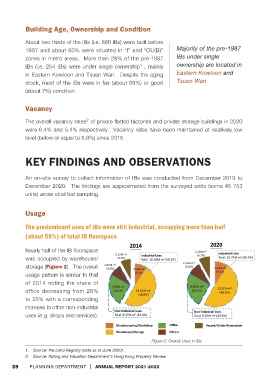

Usage

The predominant uses of IBs were still industrial, occupying more than half

(about 58%) of total IB floorspace

Nearly half of the IB floorspace

was occupied by warehouse/

storage (Figure 2). The overall

usage pattern is similar to that

of 2014 noting the share of

office decreasing from 28%

to 25% with a corresponding

increase in other non-industrial

uses (e.g. shops and services).

Figure 2: Overall Uses in IBs

1. Source: the Land Registry (data as at June 2020).

2. Source: Rating and Valuation Department’s Hong Kong Property Review

39 PLANNING DEPARTMENT │ ANNUAL REPORT 2021-2022